Between political misdirection, complex accounting treatments, and often out of date information, it is not always easy to address what we know about Higher Education finances. This article provides a short review of the latest publicly available Higher Education Statistics Agency (HESA) data release to summarise what we know.

This work forms part of an ongoing project with the Centre for Research into Accounting and Finance in Context (CRAFiC) to more systematically address the risks faced by Higher Education institutions.

The politics of university deficits

Before looking at the finances in detail, a brief note of caution on some of the more misleading statements in the public domain on university finances and financial deficits. With reference to the ongoing dispute with the UCU trade union, University representative body UCEA cite the latest ârecord deficitsâ in their , concluding with the claim that there is âno possibility of new or revised pay offersâ for 2023/24, with staff costs already having risen to over 60% of total expenditure. Or similarly, at the recent , one Vice Chancellor described how âthe alarm rings in Vice Chancellorâs ears every dayâ over the âgrowing aggregate net in-year deficit[s] for the sectorâ.

As analysed below, these ârecord deficitsâ were, in fact, the result of accounting adjustments that are set to be reversed out in the 2024/25 accounts. In total, a ÂĢ6.1bn âcostâ was posted to the 2021/22 accounts relating to the 2020 USS valuation deficit, which more than accounts for the sector wide ÂĢ3.6bn deficit . Adjusting for the USS and other above the line pension movements, this analysis shows that the like-for-like figure was actually a sector wide surplus of ÂĢ2.7bn.

, this sort of misdirection is not new â in the 2018/19 Higher Education accounts we saw the widely discredited 2017 USS valuation deficit hit University balance sheets, only to be promptly reversed out the following year. When those 2017 deficits hit the accounts, Mark E. Smith, then chair of UCEA, âon the edge or beyond [âĶ] look at the number of institutions that have reported deficits this yearâ. However, when those deficits were reversed out, leading to record surpluses, the in Higher Education omitted the entire dataset for 2019/20 from their analysis, instead focusing again on the inflated 2018/19 deficits to make the case for pay restraint.

The rhetoric and reporting on financial performance in Higher Education matters for several reasons, and not just because UCEA, on behalf of employers, would like to avoid revising their proposed pay settlements. Since the trebling of tuition fees to ÂĢ9,000 in 2012, fees have been largely frozen for English domiciled students, due in no small part to the . In 2019, proposed a reduction in the cap on undergraduate student fees to ÂĢ7,500, which could, in principle, threaten the financial business model of many institutions. Similarly, Higher Education employers have long bemoaned their commitments to fund staff pensions â most well known, perhaps, is the long running dispute over the USS, but more recently concerns have also been raised over contribution rates on the TPS, with some employers taking the extreme step of transferring staff to subsidiary undertakings in order, seemingly, to .

Conversely, the is often highly simplistic, focusing on top-line revenue growth and aggregate figures with little consideration of the structural issues of marketisation or the variation within the sector. On closer analysis, this article uncovers a sector financially addicted to growth. This is because the wide spread of performance created by our marketized model will quickly drive courses, disciplines, or entire institutions into crisis should the market saturate or falter.

In recent years we have seen much , both in terms of fees and the saturation of home and international student markets. Within an overall strong picture, there have been a number of institutions, or subject areas within institutions, that have gotten into sometimes high-profile financial difficulty. Furthermore, even at the stronger institutions, much of the growth we have seen in the sector and came at the expense of both student education and staff working conditions.

Focusing on the finances, I update this picture by looking at the sector wide aggregate figures on a like-for-like basis, with reference to our reading of the underlying disaggregated results, before concluding with some observations on possible future developments.

The sector wide bottom line

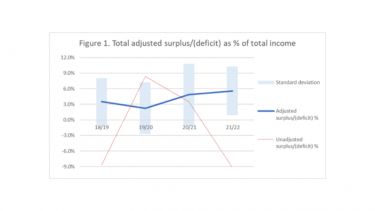

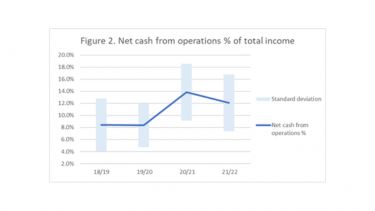

Adjusting each of the past four financial years for the misleading pension provision movements, and restricting our analysis to the 175 institutions with July year ends included in the four most recent HESA releases, we get the following graphs of adjusted surplus as a percentage of total income and net cash from operations as a percentage of total income. In Figure 1., in dark blue are the sector wide averages for the adjusted surplus and in red are the unadjusted surplus/(deficit) percentages. The light blue bars represent a spread of half of one standard deviation either side of the mean, so that around 40% of institutions will lie somewhere within the light blue bar, around 30% somewhere above, and 30% somewhere below. Similarly, in Figure 2. the dark blue line shows the average net cash from operations as a percentage of income, and the light blue bars the spread across the sector:

Overall, it is clear that the sector had a remarkably good pandemic â increasing adjusted average surpluses to 4.9% in 2021 and then again to 5.6% in 2022, well ahead of pre pandemic levels. For the 175 institutions analysed this comes to ÂĢ2.5bn in 2022, or ÂĢ2.7bn if we take the entire HESA dataset. Let that ring in your ears.

The second observation is not so encouraging, however. That spread of half a standard deviation either side of the mean already drops into deficit territory in 2019 to 2021, and hovers only slightly above in 2022. To provide some precise figures, of the 175 institutions analysed, 49 were in deficit in 2019 after adjusting for non-cash pension movements, 62 in 2020, 33 in 2021, and 35 in 2022. 20 institutions reported adjusted deficits in at least three out of the past four years, of which 5 reported deficits in every single year.

The second graph of net cash from operating activities helps sense check these results, and once again underscores the overall financial success Universities made of the pandemic. On closer inspection of the underlying data, noting that we have already adjusted out the non-cash pensions movements from the accounting surpluses, the remaining differences between these two graphs relate primarily to depreciation on fixed assets and movements in working capital (plus a number of smaller items detailed in HESA table 4), with the year to July 2021 benefitting more than other years from favourable movements in working capital.

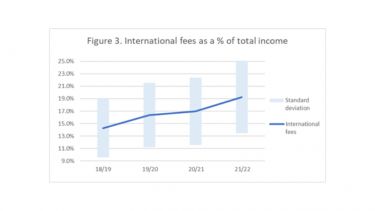

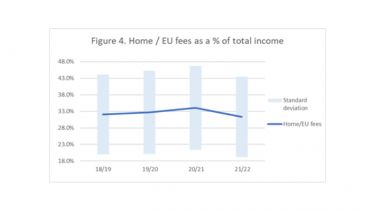

There is considerable additional analysis to perform to unpick these surplus figures, and similarly to understand the movements within the sector that are not visible in such a high-level analysis. Some of which will be covered in our upcoming analysis for the CRAFiC research centre. However, an initial review of the data makes several things fairly apparent. Overall, the improved surplus and cash generation in 2021 and 2022 relates to growth in high-margin international student fees (particularly in 2022) and tight restraint over the single largest expenditure item, namely âstaff costsâ (particularly in 2021). In 2021 we also see a significant boost in Home/EU fees as institutions dropped their entry requirements to compensate for an anticipated drop in international fee income (a drop that did not ultimately materialise, at least in aggregate across the sector). This was somewhat offset by a temporary drop in âother incomeâ in 2021 as many University buildings and campus facilities closed during locked-down.

, at the outbreak of the Covid-19 pandemic, many of the (seemingly) riskiest institutions appeared to fit the profile of post-92 institutions with high debt and high reliance on international fee income. With my analysis referencing the , and surveys released by and the to cast international fees as a major risk factor, due to the uncertainty in international student recruitment and wider fears over the saturation of the HE market. Concerns that are still highlighted strongly in the last year on the sustainability of Higher Education finances.

In the event, however, these fears over international student recruitment during the pandemic proved largely unfounded as Universities increased home student recruitment and convinced the 2020/21 student intake to enrol on their courses and register for university accommodation. Many University campuses and residences did then promptly go into lock-down from October 2020, but by that point students had been locked-in to course fees, accommodation costs, and in some cases .

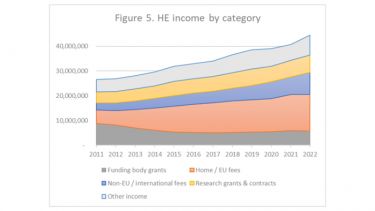

The following Figure 5. illustrates these trends against the longer-term backdrop of funding for Higher Education, starting just prior to the trebling of undergraduate tuition fees in 2012:

In the years following the trebling of fees, Universities hugely expanded their fee income from home/EU students, before, from the mid-2010s onwards, focusing heavily on international student recruitment. By 2022, the total student population had grown to 2.9m, with over 100,000 more UK domiciled students and 250,000 more non-UK domiciled students studying in the UK since 2010/11. The transition to home student growth in 2021 in response to the pandemic appears, therefore, to have been a slight anomaly, before bouncing back to trend in 2022. Suggesting that there is still excess demand in the domestic market.

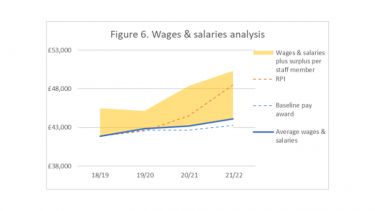

Turning to staff costs, the chart below brings out the aggregate sector wide pay restraint against inflation. Drawing on the data from institutions with July year ends, we see that staff costs were restrained in 2021 by the imposition of a by UCEA, together with recruitment freezes and voluntary severance arrangements across many institutions:

This graph measures inflation using the RPI rate from the July year end back to the start of that financial year, and therefore captures the high inflation rate as at July 2022. It also shows the average sector wide surplus per staff member, in orange. This is purely illustrative but shows there was, at the aggregate level, sufficient surpluses sector wide to match even RPI inflation in recent years. However, it is also important to consider the spread of results across the sector as opposed to the purely aggregate results.

At the risk of complicating the graph, we can add the light blue bar representing half of one standard deviation around the surpluses to the orange âwages and salaries plus surplusâ line, to see just how many institutions can individually afford such pay increments. Once this information is added, we can see that while the sector wide data is very strong, it does conceal considerable variation by provider:

Despite this variation, 2022 still appears to have been the one year in recent times when providers were best placed to make an enhanced pay settlement, not just because of the overall increase in surplus but also owing to the somewhat reduced variation in adjusted surpluses across the sector that year.

The Higher Education balance sheet

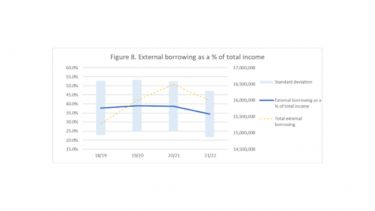

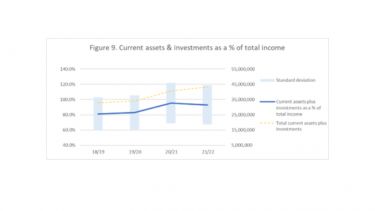

Finally, a brief comment on the Higher Education balance sheet position. Due to the public nature of most Universities, the lack of profit extraction during periods of cash and operating surpluses typically translates into improved balance sheet positions, either via increased investment in fixed assets, repayment of debt, or improved liquidity. We can see this to be the case in Figures 8. and 9., with the dark blue line showing the average âexternal borrowingâ and âcurrent assets and investmentsâ as a proportion of total income shown by the dark blue (with the percentages on the left hand side) and in total shown by the orange dotted line (with units in the ÂĢâ000s on the right hand side):

Once again, this requires considerable additional analysis, but at the aggregate level we can see that there is an improved debt position as a proportion of total income and improved liquidity through 2021 and 2022. Indeed, that drop in total debt in the year to July 2022 is the first drop in total debt in the sector for many years. , the Higher Education market has been fuelled by excessive growth, with many institutions having become structurally reliant on high debt, precarious employment, and cross subsidisation from high-margin courses to remain viable. Total external borrowing grew by 48% in the four years to 2019, before peaking at record levels in 2020/21, a near 60% increase in just six years. The drop in 2022 therefore reflects the operating surpluses that year, but also perhaps an element of caution in relation to debt driven expansion that we have not seen from Higher Education providers over most of the preceding decade.

Looking to the future

In sum, it appears that the sector continues to report strong financial health at the aggregate level, but with considerable variation within the sector. The nature of the Higher Education market, or indeed any free market, is such that to remain âviableâ, âcompetitiveâ, or financially âsustainableâ providers must worship the needs of the market before all else, or face an existential threat. Ironically, going into the Covid-19 pandemic it appeared that aggressively pursuing international student recruitment by leverage fuelled expansion had created the conditions for market collapse. But this did not prove to be the case. Providers were able to restrain staff costs, owing to the highly insecure employment conditions across the sector and the imposition of a 0% pay settlement, drop entry requirements for home students, and, in the event, maintain if not expand international student numbers. This led to increased surpluses in 2020/21, but also meant providers went into 2021/22 with reduced overheads, such that the bounce back in international student recruitment on high-margin courses led to even greater surpluses.

So what does this mean for the future? For now, the Higher Education business model of student number growth and precarious employment predominates, albeit with a temporary slowdown in the expansion of University buildings and physical infrastructure. Looking at the disaggregated results more closely, there does appear to have been a shift in the risk profile of institutions, with a number of research-intensive universities finding themselves in increasing difficulty. As we look forward to 2022/23 accounts, we would anticipate inflationary pressures to start to bite, and concerns over academic quality, student diversity, and staff workloads to limit further expansion of high-margin courses. Institutions rising up across a number of risk indicators, and in a number of cases announcing staff redundancies, now appear to fit the profile of lower ranked âresearch intensiveâ institutions with high overheads and a reluctance to transition to a business model of cross-subsidisation from more generic high-margin high-student-number course provision.

In aggregate, the market as a whole continues to resemble a bubble â structurally reliant on growth, continued high levels of debt (still at ÂĢ16bn as at July 2022), and increasingly precarious working conditions. As the post 1998 Higher Education market experiment continues, we might wish to focus on whether a highly precarious, generic, debt-leveraged âbusiness modelâ addicted to student number growth that the current market incentivises is really what we want for our sector.

Notes

[1] For figures 1. & 2. we analyse the 175 institutions included in each of the HESA data releases for 2018/19 through to 2021/22. For figures 3. To 9. we use the slightly wider data set for all HE institutions with 31 July year ends.

[2] For figures 1. To 9. A total of 13 institutions were omitted from the HESA data release due to late filing. Of these we manually included the results of four institutions and carried over the 20/21 results for the remaining 9 institutions.